Deposit

Easily deposit funds into your account with either bank transfer, credit card, or crypto transfer.

No fees on Bank Transfer or crypto Transfers

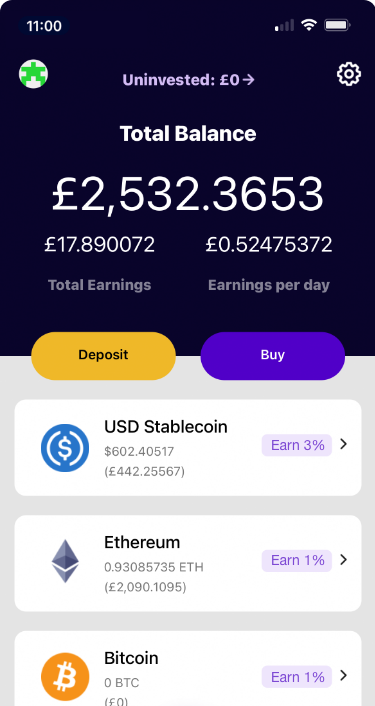

No fees on Bank Transfer or crypto Transfers AQRU offers the perfect way to earn interest on your crypto portfolio. Our easy to use platform tracks your interest payments by the hour and pays interest daily, so you can start benefitting from high returns immediately.

AQRU accounts are now available with a minimum balance of USD250k.

Our team of experts find and vet the best crypto yield providers out there. Earn up to 10% APY on your crypto, with the confidence of knowing where your yield comes from.

If you’re looking for a reliable and easy way to invest in cryptocurrency, AQRU is the platform for you.

This calculator is for informational purposes only.

Making a deposit with AQRU is quick and easy, so you can start earning interest on your investment right away. Plus, with our user-friendly platform, withdrawing your money is a breeze.

Our useful FAQs and Help Centre are available for further information.

Easily deposit funds into your account with either bank transfer, credit card, or crypto transfer.

No fees on Bank Transfer or crypto Transfers

No fees on Bank Transfer or crypto Transfers Earn daily interest of up to 3% APY on your cryptocurrency, tracked to the hour.

| | +10% |

| | +3% |

| | +1% |

| | +2% |

| | +0% |

| | +0% |

Request a withdrawal and receive funds within 24 hours, available as fiat or crypto.

No fees on Fiat withdrawals

No fees on Fiat withdrawals AQRU is the perfect investment system for anyone looking to maximise their earnings while keeping their money secure. AQRU makes it straightforward to get started in crypto investing with competitive interest rates and a user-friendly platform.

AQRU offers a quick and easy way to start earning interest on your crypto investments. Our fast funding process allows us to complete most transfers in as little as an hour so that you can benefit from returns right away. With both fiat transfers and crypto-to-crypto transfers available, getting started with AQRU is simple. Some deposits can take up to 24 hours.

AQRU is an Authorised Virtual Assets Service Provider that strives to achieve the highest financial responsibility standards, so you can rest assured that your money is in good hands. With our innovative technology and unique platform, we are committed to helping our clients reach their financial targets.

If you’re looking for a safe and secure way to invest your money, AQRU is the perfect solution. We protect your assets using innovative wallet technology and fully insure all deposits to decentralised exchanges against hacking. In addition, we 100%+ collateralise money loaned to retail investors and institutions. With AQRU, you can rest assured that your investment is in good hands.

Refer someone and get 100USDC for you and your friend.

Kristin MeshinskaVery friendly customer support and referal program was great! Customer support swiftly helped me solve an issue with minimal fuss involved.

JustinFantastic app! Has helped me get involved in crypto and made a confusing world much more simple.

Lachezar AlexandrovVery user-friendly experience with the app. Perfect for beginners as it is super intuitive an easy to use. Customer support were really nice and responded immediately whenever I had any questions.

AQRU provides robust security for your digital assets by using encryption in transit, encryption at rest, and address whitelisting. Security is a top priority for us, and we work hard to create a platform that you can trust.

With AQRU, you can easily invest in the cryptocurrency of your choice and earn a competitive return. Whether you’re a complete beginner or an experienced investor, we make it simple for you to benefit from investing in crypto.

The AQRU platform makes it easy for you to get started. To begin benefitting from our high-interest returns, you first need to register and create an account with us. Then, following verification, you can purchase or transfer crypto into your wallet and earn interest immediately. AQRU accounts are now available with a minimum balance of USD250k.

With interest as high as 10% APY, AQRU offers competitive returns on your holdings. We get you the highest rates possible by carefully selecting the best investment options. So register today and enjoy peace of mind knowing your money is in the safe hands of our experienced team!

AQRU provides a safe and secure investment platform for our clients. We use the latest security technology to protect your assets and personal information. A two-factor authentication process protects your AQRU account, and we use industry-leading security protocols to keep your funds safe.

When you use AQRU, you can feel confident that we protect your digital assets against the risk of hacking with cutting edge wallet security. For added peace of mind, our $30 million cover policy guards your investments in the unlikely event of a third-party hack.

Cryptocurrency value can decrease over time for various reasons, meaning that we can’t protect against coin risk. However, AQRU only offers access to the highest liquidity crypto markets, reducing the risk of this affecting our clients. Our approach ensures that you can trust us to provide you with a smooth and reliable investment experience.

AQRU accounts are now available with a minimum balance of USD250k.

With AQRU, you have the freedom to take out part or all funds at any time, in either fiat or crypto. Withdrawals are quick and easy, so you can access your funds when you need them.

To get started, simply request a withdrawal via your Account page. Please see our Help Centre for a step-by-step guide.

AQRU offers fee-free fiat withdrawals. We charge a $10 fee for Bitcoin withdrawals and $20 for withdrawals in other cryptocurrencies, payable in the asset you take out.

AQRU currently accept the following payment methods:

*Currently accepting BTC, ETH, USDC

AQRU acts as a custodian and takes full control of your assets once you deposit into our system, so you can rest assured knowing your funds are in safe hands. In addition, our wallet insurance protects your crypto, so you can feel confident that your funds are secure. And if you ever need access to your funds, you can easily withdraw them as either fiat or crypto – anytime, anywhere.