Market-leading yields

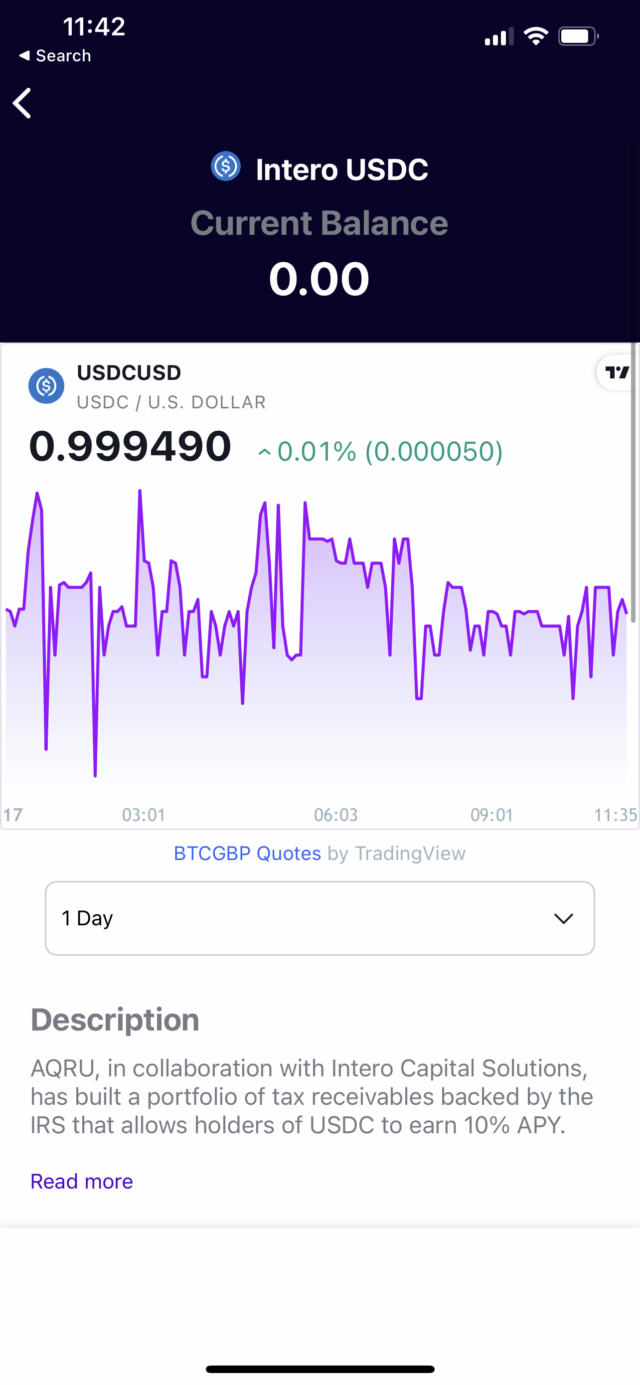

Earn 10% APY on your USDC. Interest rates are fixed for the duration of the lock-in period. AQRU accounts are now available with a minimum balance of USD250k.

Earn up to 10% APY financing real-world receivables.

We’ve partnered with Maple Finance and Intero Capital Solutions to give our customers access to a unique financing program bridging DeFi and the real-world, focusing on tax credits provided by the US IRS, funded in USDC, and paying 10% APY.

The Internal Revenue Service (IRS) issues tax credits under various programs, designed to encourage growth and relief in targeted sectors of the economy.

In partnership with Intero, AQRU has designed a program that advances digital assets to program participants, against their pledged IRS tax credits. The individual tax credits we focus on are due to be settled by the IRS within 3-5 months. This ensures we can match liquidity with customers’ needs.

Intero sources the IRS tax credit receivables through their network of IRS tax credit originators. Intero performs both financial and operational due diligence screening, whereby originators are required to demonstrate a successful track record and pipeline of tax credit submissions, and the robustness of their back-office processes.

This unique quasi-government backed solution bridges DeFi and traditional finance, by directing digital assets (in this case USDC) to help foster real-world economic growth. The funds provided by AQRU in the program enable companies to access essential liquidity months in advance of their tax credit being paid by the IRS.

Earn 10% APY on your USDC. Interest rates are fixed for the duration of the lock-in period. AQRU accounts are now available with a minimum balance of USD250k.

The AQRU Real-World Receivables account has a 45 day lock-in period, after which you can either withdraw all your USDC and accumulated interest, or let it roll over for a further 45 days.

Intero Capital Solutions LLC, founded in early 2021, is a provider of funding solutions that focus on creating additional liquidity for targeted commercial and Government programmes.

Intero actively provides high-quality and dynamic funding services that fully exploit the inherent commercial value locked in quality receivables and other real-world assets. Intero achieves this by bringing together traditional and digital investors, asset originators, and other enabling entities to create and execute funding transactions.

The founding team has been working together for six years and, in that time, has executed around USD2bn of receivables transactions.

By bringing real-world assets into the digital ecosystem, Intero is positioned to increase the latter’s resilience by bridging the gap between traditional and digital financing structures. Through its partners, Intero also provides additional capabilities in longer-term project finance, debt funding, and equity investments which are complementary to these shorter-term receivables solutions.

Intero is focused on developing the digital asset ecosystem, including collateral-backed DeFi liquidity pools and the evolution of the carbon credits economy.

How we selected Intero Capital Solutions:

We undertake extensive due diligence when selecting our yield partners. Among other things, we look at the technology backing the platforms, the team’s experience and reputation, how they structure their funding programmes, and most importantly the company’s financial position.

Why we selected Intero Capital Solutions:

We selected Intero Capital Solutions due to their unique receivables factoring programme, offering an opportunity to apply DeFi funding to quasi-government backed programs with material real-world benefits.

Intero operates an extensive network of vetted asset originators who source companies that are current or potential recipients of IRS tax credits. Intero has the expertise and technology to undertake the necessary risk mitigation and operational functions to assess and process the tax credits transactions. Intero’s agile back office environment provides the operational framework to accurately and consistently execute high volumes of transactions.

As always, every customer should undertake their own review of all products and services offered by AQRU to ensure it aligns with their risk profile and investment criteria.