Crypto Market Crash: Recovery Is Only A Matter Of Time

So, you might have heard there was a cryptocurrency crash. There was panic! There were headlines! Bankers queued up to say “I told you so!” (more on that later).

But what really happened? Should you panic? (spoiler: no!) Has this happened before, or anywhere else? What does it mean for the future of cryptocurrency?

But if you’re looking for reassurance upfront, here’s the hot take:

The Hot Take on the Crypto Crash

The 20%ish flash crash that happened in the Bitcoin price in May doesn’t even rate in the top 10 of Bitcoin crashes. It was primarily due to a spectacular technology car crash on a dubious unrelated coin that happened to end up dumping Bitcoin onto the market and depressing the price in a flash crash, before recovering. It doesn’t alter the underlying worth of general cryptocurrency, and the only long-lasting impact it might have is to change the ecosystem of stablecoins and speed up a new era of Central Bank Digital Currencies (CBDCs).

Most reporting used the flash crash to draw attention to the cryptocurrency bear market that has been going on for some time and imply that the two were related, in order to make a story. But that’s lazy reporting mostly driven by the need for clicks and the need for traditional finance to distract from their own woes by hitting on the crypto market.

Ironically, some of the problems here were that the crypto market and the regular stock market are linked like never before: so much of the investor panic was caused by traditional finance people selling their crypto because it was easier to sell than their more traditional assets (24/7 markets) and because they didn’t want their clients to know they had crypto.

Fun fact: did you know that traditional finance has more of a hand in crypto than ever before? Surprise!

Let’s get some perspective – a brief history of crashes

OK, so if you’re in the mood for a read, let’s have a calm look at what’s going on. Unemotional investing is the only kind you should be considering right now, so grab a tea and let us explain.

“History doesn’t repeat itself, but it does rhyme” – Mark Twain

It’s important to separate the normal workings of a market over time (where prices can go up and down over long periods), and short-term crashes. The crashes are dramatic and spectacular, and the reporting is breathless!

But what’s important is their impact on the market’s long-term prospects. Was it a glitch, or the inevitable results of greed and stupidity? Have lessons been learnt?

Yes, cryptocurrencies are down since January

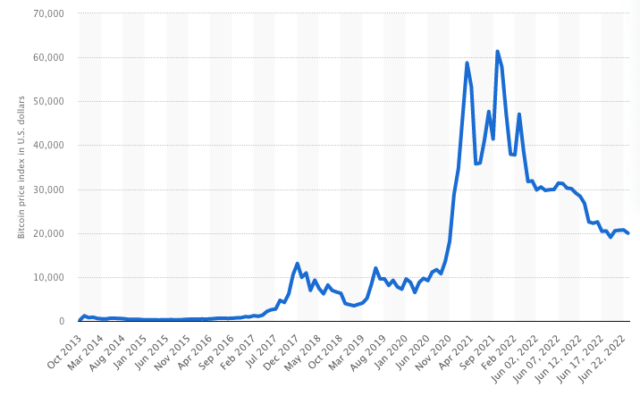

It’s certainly true most cryptocurrencies are down in price since the beginning of 2022.

Using data from CoinMarketCap.com, on 1st January 2022, Bitcoin closed at $47,686.81 and closed yesterday (22nd June 2022) at $19,987.03 – this is a drop of 53%. Ethereum closed at $3,769.70 on 1st January and at $1,051.42 yesterday – a drop of 72%.

Why? This is partly the natural movement of a healthy market, whether it’s a stock market, a commodities market, or a crypto market.

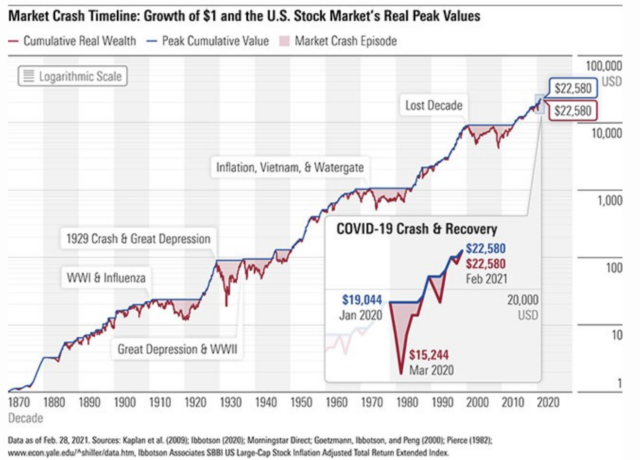

Markets of all kinds go up and down naturally. That is unless they’re artificially stabilised, like the US Federal Reserve did for the COVID stock market plunge of 2020, helping it to bounce back from massive losses to pre-pandemic highs.

Sometimes this natural movement is due to chronic factors, such as a recession. Sometimes it’s a reaction against over-enthusiasm.

Sometimes a market will move downwards very, very quickly. That’s a crash, obviously.

For each of these crashes, you can identify them as a combination of:

- Something is wildly overvalued and warning signs were ignored

- A new idea has gone horribly wrong

- War and/or plague

- A change in the rules

Stock Market Crash – 1929

For instance, the stock market crash of 1929 was driven by a new idea: buying on margin.

According to a recent article:

“In the 1920s, prior to the crash, a financial practice called buying “on margin” was invented. It allowed people to borrow money from their brokers to buy stocks. In many cases, people could leverage a large amount of borrowed money from a small initial investment. Investing this way may have contributed to the irrational exuberance of the Roaring Twenties.”

Black Monday – 1987

Black Monday was essentially another brilliant new idea gone horribly wrong: programmatic trading.

“It is thought that the cause of the crash was precipitated by computer program-driven trading models that followed a portfolio insurance strategy as well as investor panic.” (see the full Investopedia article here).

Dot Com Bubble – 2000

Now to 2000, and the Dot Com bubble, which was caused by deregulation and wildly overvalued tech stocks, and ignored warning signs. Remember, this is still “traditional” finance!

“Many investors foolishly ignored the fundamental rules of investing in the stock market, such as analyzing P/E ratios, studying market trends, and reviewing business plans. Instead, investors and entrepreneurs became preoccupied with new ideas that were not yet proven to have market potential. Furthermore, they ignored the blatant signs that the bubble was about to burst, as indicated by Larry Elliott, economics editor of “The Guardian.” (See original source).

Global Financial Crisis – 2008

The 2008 financial crisis was a particularly nasty combination of a “brilliant” new financial idea – derivatives based on mortgage debt, and a wild dose of overvaluing and dishonesty about the risks, as well as further deregulation.

“The financial crisis was caused by unscrupulous investment banking and insurance practices that passed all the risk to investors.”

And the taxpayer footed the bill.

Coronavirus Crash – 2020

In 2020, the COVID crash caused a big drop, causing massive Government intervention.

According to Forbes:

“Personal Capital’s Chief Investment Officer, Craig Birk says if we learned anything from 2020, we learned why it’s so important to have a long term plan and stay the course. There were a lot of stories this past year that were hard to understand. In reality, the market didn’t change much, and the average investor’s big picture goals didn’t change. But so many storylines around coronavirus and the election caused a distraction.”

Bitcoin has pretty much the same reasons for crashing, it just does it quicker

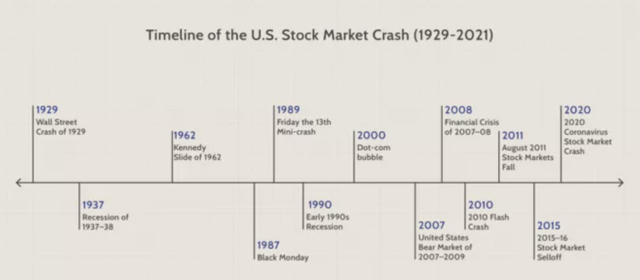

Here are the major stock market crashes:

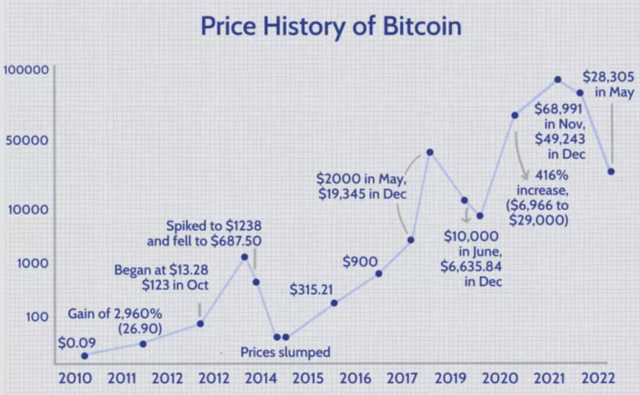

And here are the major Bitcoin crashes (Bitcoin has the longest history, and is a good marker for the rest of the sector):

While traditional finance reserves its crashes for every 10 years or so (give or take), cryptocurrency has its crashes in internet time.

This is partly because the market is much smaller than the traditional finance market, and has a lot more exposed technology and new financial ideas.

Both of these factors make it much easier for the market to be affected by smaller players, such as hackers. Someone dumping 10 million dollars onto a market is a blip in traditional finance, but a whale in cryptocurrency, though this becomes less true as time goes on.

Bitcoin crashes – more perspective and… what happened after the headlines?

Investopedia’s article on Bitcoin is recommended reading!

Yahoo Finance has a good article about the 7 biggest Bitcoin crashes. May 2022 is not one of them!

“Keep in mind that many major corrections of 20%, 30%, 40% and more didn’t make the list.”

An extremely good article covering the early crashes of Bitcoin was written in April 2013 by Forbes. We shall be quoting from it: it covers some of the earlier crashes that the Yahoo article ignores, and provides a valuable time-capsule into how Bitcoin was being covered.

June 8-12, 2011 – Technology Glitch – Bitcoin crashes 99%… or does it?

An exchange hack at Mt Gox, by far the biggest Bitcoin exchange at the time. To Bitcoin, this was like The New York Stock Exchange getting hacked for trillions of dollars and confidence in Bitcoin cratered – even though it wasn’t Bitcoin that was the problem.

But what happened next?

Well, the price didn’t stay at $0.01, a fact lost to history. In fact, Timothy Lee’s article states that the peak price was $32 and the price decline was 63% – not nothing, but not the alarmist 99% that the press loves to quote.

“A few weeks after these events, after many false starts, trading at MtGox eventually resumed and the bulk of the trades were reversed. However, to this day, as far as we are aware, MtGox has not been able to provide a coherent explanation for what occurred. The lack of a consistent narrative from MtGox led many to believe that MtGox had poor monitoring and control of its systems and that the company was run negligently. Many concluded, “never to trust MtGox again”. (See original source)

Aside: Do you want to hear something ironic? Bitmex itself went on to be a large part of the problems going forward, thanks to the same thing that created the Great Depression: uncontrolled margin buying and leverage by inappropriate people.

What happened next?

“A sharp recession in cryptocurrency markets followed, and Bitcoin’s price bottomed out at $2.05 by mid-November. The following year, its price rose from $4.85 on May 9 to $13.50 by Aug. 15.” (Investopedia)

…at which point, the bubble burst…

Was Bitcoin actually a bubble?

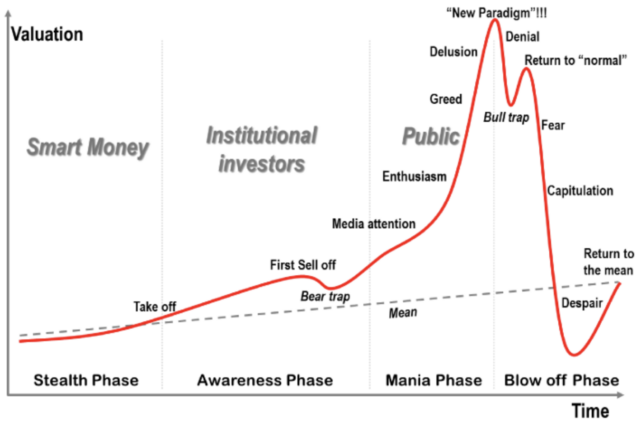

At this point in Bitcoin’s history, it had very little real-world application, so it was a highly speculative investment. But with a business plan to take over the world. Rather like Amazon, in fact. Was it a bubble? Well, anyone who bought a bitcoin at any time during this period and then kept it would have to disagree! In fact, Bitcoin’s history looks remarkably like the Gartner hype cycle.

Basically, a repeated version of this:

August 17-19, 2012 – Bitcoin crashes 51%

Event: a Ponzi scheme was uncovered that stole 700,000 bitcoins by promising 7% returns a week. Again, not Bitcoin’s fault, but a greed-powered disaster. (See original source).

Was the August crash caused by the guys behind the scene cashing out? We might never know.

What happened next?

“Bitcoin prices more than doubled between July 1 and August 18, 2012. Then in a matter of minutes, the price of bitcoins fell from $15.25 to $10.50. The decline continued over the next two days, reaching a low of about $7.50. The price didn’t rise above $15 again until the new year.”

“Early 2013 saw an extraordinary Bitcoin boom. By the beginning of March, Bitcoin prices were already double the 2012 high, and they rose another 50 percent over the next week… two crashes didn’t have any noticeable impact on Bitcoin’s upward price trajectory. Bitcoin prices would reach $60 on March 19 and end the month above $90.” (Forbes)

April 2013 – Bitcoin crashes 80%

Mt Gox is hacked again and shuts down. Comically, recovered funds later caused another mini-crash when an inept trustee tried to liquidate some on the open market…

What happened next?

On April 11th, Forbes magazine covered Bitcoin crashes so far. It’s entertaining to read it knowing what we do now… and noting that many people thought this crash was terminal and that $260 Bitcoin was a bubble the coin would never see again…

“The claim that Wednesday morning’s prices were a bubble is ultimately a prediction about the long-term value of the currency. If bitcoins are worth $500 in 2018, we’ll look back at Wednesday’s sell-off as a freak event that (like the other crashes that came before it) temporarily halted the rise toward the currency’s real value. Conversely, if a bitcoin has fallen to $5 five years from now, we’ll shake our heads at the irrational exuberance that once valued a bitcoin at $260 (or $32, for that matter). But right now, it’s simply too early to tell.”

Buy that man a Satoshi! But what happened to the price?

“It began the year trading at $13.28 and reached $230 on April 8; an equally rapid deceleration in its price followed, bringing its price down to $68.50 a few weeks later on July 4.” (Investopedia)

December 2013 – Bitcoin crashes 50%. China bans Bitcoin for the first time and fear floods the market… not for the first time

What happened next?

“In early October, Bitcoin was trading at $123.00; by December, it had spiked to $1,237.55 and fell to $687.02 three days later. Bitcoin’s prices slumped through 2014 and touched $315.21 at the start of 2015. Prices slowly climbed through 2016 to over $900 by the end of the year.

In 2017, Bitcoin’s price hovered around $1,000 until it broke $2,000 in mid-May and then skyrocketed to $19,345.49 on Dec. 15.” (Investopedia)

December 2017-December 2018: Bitcoin value reduced by 84%

Note that we’re not even describing a single-event crash here – but there were lots of mini-crashes, one of which was the false rumour of “India Banning Bitcoin” in Q1 2018.

… and from there on, the story is ups and downs.

“Bitcoin’s price reached just under $29,000 in December 2020, increasing 411% from the start of that year. By the summer of 2021, prices were down by 50%, hitting $29,796 on July 19. Autumn saw another bull run in September, with prices scraping $52,693, but a large drawdown took it to a closing price of $40,710 about two weeks later.” (Investopedia)

BTW: cryptos are highly correlated to Bitcoin so the above pretty much describes the pattern of the whole crypto market – except smaller coins moved more.

What happened during the May 2022 crash?

The May crash of 2022 wouldn’t even make any of the lists of big crashes: Bitcoin dumped briefly from $30,000 to $26,000 and then back up to $29,000 – although it has since fallen to around the $20,000 mark in mid-June 2022, in the context of wider economic malaise.

So why was it so dramatic? Well, this time the problem was nothing to do with Bitcoin, but it goes back to a long-standing problem.

Lunatics and stablecoins

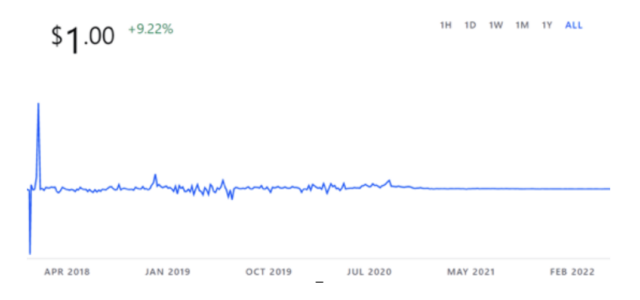

The May 2022 crash was caused by a run on what’s called a “Stablecoin”. The particular stablecoin was “UST”, and it was designed to maintain a “peg” to the US Dollar. That peg failed, causing the problem. We’ll go into detail after a bit of background.

Stablecoins generally were created to solve the problem of how to trade non-blockchain assets on a blockchain. There was a desperate need for a digital dollar, above all. Something to represent the dollar in trades with other cryptocurrencies, rather than something you would actually spend.

For more information, have a look at this.

“Since the beginning of 2017, about 200 teams worldwide have announced stablecoin developments, but many projects failed to implement them in the end. Nowadays, less than 30% of the stablecoins ever released continue to exist, according to data collected by Blockdata.”

While the article is hot on the concept of stablecoins as a necessary part of the ecosystem, it’s clear that many are experimental, and the article ignores the oncoming Central Bank Digital Currencies. You can also find more here.

However, since the first stablecoin (DAI) and the most popular (USDT) were launched, stablecoins have been an integral part of the ecosystem.

But how do you make a coin worth something, let alone $1?

USDT (“Tether”) went the most obvious route: claiming that it was backing up every issued USDT with an equivalent dollar in storage. This claim has been modified and the quality of Tether’s reserves disputed. USDT also lost its peg to the dollar in this crisis, temporarily at least, but has recovered.

USDC (“US Dollar Circle”) performed well during the crash, at one point being worth slightly more than a dollar, and is also claimed to be fully backed by dollars.

DAI and UST, by contrast, are “algorithmic” stablecoins. Every algorithmic stablecoin has a different way of making itself worth something.

DAI, the first stablecoin, derives its value from “Collateralised Debt Positions”, and has proven to be pretty stable (though it’s not a good time to be an algorithmic stablecoin right about now). In fact, it got more stable over time.

Now, UST… that’s another story

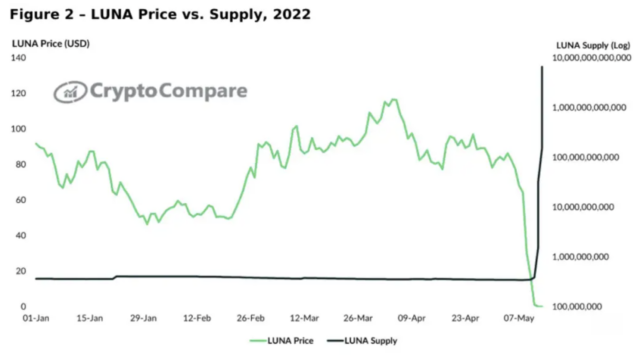

UST’s big idea was to create a stablecoin that was backed by another cryptocurrency also created by the same people: LUNA.

A complex algorithm mechanism involves buying, selling and burning either coin to keep the value of UST at $1. Central to that is paying an (unrealistically high) yield rate of 20% on LUNA deposits to the blockchain.

The only asset worth anything in this picture is a fund of Bitcoin that could buy/sell Bitcoin to help maintain the $1 peg. But that was a tempting target to opportunists… and this stablecoin (and its sister coin) was soon to be under attack, resulting in UST at a fraction of its peg, and the value of LUNA cratering by over 99%.

So, what happened?

Well, thanks to a very observant Twitter user called “4484” (catchy name), we have an explanation that makes sense: it requires a great deal of co-ordinated money to bring down a stablecoin. And some billionaire or cartel just got very rich indeed…

- Attacker buys $1Bn UST – but not on the exchanges, it’s bought OTC (which means “over the counter” – a lot of cryptocurrency is bought with deals behind the scenes rather than from exchanges, to get a discount and to avoid altering the price during the deal).

- Attacker places large bets on Bitcoin going down in price (“shorts”). These will pay off massively if it tanks – which of course it did.

- Attacker borrows $3bn of Bitcoin (but doesn’t need 3 billion to do it – just a fraction of that). This is because he can use “leverage”.

- Attacker dumps their 3 billion of Bitcoin on the market to trigger a panic. Which it does.

- 10 minutes later, the UST algorithm starts to compensate, and the attackers pounce. They use some of their UST to remove all the liquidity from the coin, then start selling the UST to rip UST off its dollar peg (but not by much).

- UST’s “Terra market module” starts selling off its bitcoins to try and restore the peg while the attackers pile the pressure on by selling their UST: as is everyone else now. LUNA is tanking. The more Bitcoin the coin automatically sells, the lower Bitcoin goes, and the worse things get.

- All cryptos go down because Bitcoin did: they always do this, and it’s always annoying!

- Mass panic and chaos, someone steps in, stops the Bitcoin selling and UST plummets off its peg to a fraction against the dollar.

- Meanwhile, three other stablecoins lost their value in a general panic about stablecoins. One exchange had hardcoded their value to 1, and gets a huge surprise when it finds out it had lost $35m.

It’s almost certain that this would have happened in slow motion at some point organically, but the crisis here was engineered.

So, suddenly: the focus is on stablecoins. The authorities were already concerned about “things trying to be dollars”, so now, the smart money is on a new global crypto regulation body. Eventually.

But what’s the future?

In the end, the crash was dramatic and a lot of people got burned, but it’s not actually that relevant to the wider world of crypto. The wider picture in crypto is the same as it was last week, with the exception that the process of regulating it might be sped up (especially with regards to stablecoins), which, if you’ve been following the twists and turns over the last 12 years of Bitcoin, might be a good thing.

Crypto has fused with the financial system much more over the last year than at any time since its inception, and that process will continue. That ties the fate of crypto to the wider financial markets, but also gives it worth. Regulators have given up trying to destroy it: the fear of that happening drove quite a number of mini-crashes.

So, yes, the overall market will ebb and flow. But if you’re in it for the long-term and can leave your assets in place… maybe that’s for the best, and hope for another day!