How to pay off your mortgage using cryptocurrency

Wouldn’t it be amazing to be mortgage-free? For many people, paying off their mortgage is the catalyst for early retirement or going part-time and spending more time doing what they want. For many, this is only something they will experience in their late 60s or early 70s depending on how their careers progress. However, new innovative strategies within emerging asset classes such as cryptocurrency are providing hope for millions.

According to finder.com the average UK mortgage is £137,934, which, if we assume an interest rate of 4.2% will cost £767 per month to pay off over 25 years. Is there a way to pay this off faster?

What are stable strategies in crypto?

When you think of cryptocurrencies you probably think of the wild price swings attributed to Bitcoin or the latest dog-related meme coin. Although, all cryptocurrency is rightly classified as high risk, there are lower-risk strategies within this asset class. One of these is using stablecoins.

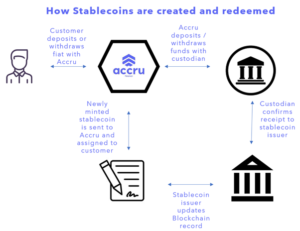

Stablecoins are cryptocurrencies that are pegged to the price of a real-world currency such as the Euro or Dollar. To create a stablecoin, fiat currency is deposited into the issuer’s bank account and held in trust. The issuer then creates a coin related to that real-world asset and assigns it to the buyer by updating the blockchain record. To redeem the real-world asset the reverse process occurs. As a retail investor, you wouldn’t have to do this process as it is most likely taken care of by the platform on which you are investing. It is always good to understand the mechanics though.

These stablecoins are extremely useful for institutions trading and investing in the crypto market and are in high demand. As such, they can be lent out to generate a yield. AQRU is a market-leading provider of yield on cryptoassets and will pay 12% per annum on the value of your stablecoin investment. It is this return that we will use to help pay off our mortgage.

Strategy 1: Switch to interest only and compound

We have already seen in our example that a £137,934 mortgage requires a monthly payment of £767 per month for 25 years or a total of £230,100.

What would happen if we switched to an interest-only mortgage and put the saving into the stablecoin strategy?

An interest only mortgage would cost us £517 per month, leaving us with £250 per month (£767-£517). If we invested this at 12% after 14 years, we would have a pot worth £141,211.25. The mortgage would be paid off with money to spare 11 years earlier saving us a total of £101,244.

This is an amazing outcome but there are multiple risks to consider including the security of your crypto, the solvency of the firm you are dealing with, and the underlying stablecoin risks. For this reason, ensure you are dealing with a regulated and preferably insured cryptocurrency provider. There are also tax implications that you would need to consider.

Strategy 2: Crypto Side Car

In this scenario you continue with your repayment mortgage, however, you set up a separate ‘side car’ or crypto investment account, that you deposit money into each month. Let us say you deposit £100 per month into your sidecar and invest it for a 12% return.

After 16 years, your mortgage balance that still needs to be repaid is £69,951 and your savings balance is £78,883.26. At this point, it is up to you whether you pay off your mortgage.

If, for argument’s sake, we did not immediately pay off our mortgage and instead continued to pay it off monthly as well as investing £100 per month into our sidecar, how would we be left after 25 years?

As per the mortgage term, the debt would be paid off. In addition, the £100 per month invested for 25 years in the 12% account would now be worth £324,352.96. A nice little nest egg for retirement.

Conclusion

All these strategies come with significant risk as they are investing in new asset classes. Hopefully, the examples above will give you food for thought when tackling some of your biggest financial commitments. AQRU’s aim is to become the safest place to earn a yield on your cryptocurrency. AQRU provides insurance against hacking and a stable platform that makes cryptocurrency simple and intuitive to understand. Sign up today and get 10 USDC for free!