What is Digital Wealth Management?

All wealth needs managing. Even small wealth. Even the smallest.

Why? Because if you’re not making sensible decisions about what your assets are doing, you might not end up with any wealth at all.

Traditionally, wealth management has been a “rich person’s thing”. A team of people working on identifying and managing your assets, while collecting a hefty fee. As you can imagine, if you’re not a “high net worth” individual, then you can forget about it.

The sort of wealth management that rich guys take advantage of involves mainly choosing where to invest or send money to keep more of it:

- Investment funds

- Stocks and shares

- Government bonds

- Art, real estate and other alternative investments

- Venture capital

- Complicated corporate structures to hide taxable gains

- Buying politicians

These are about both “investment” and “tax avoidance” (tax “avoidance” is legal, tax “evasion” isn’t – the line is pretty grey when you’re at this level of finance).

So, most of those activities are seven-figure stuff that’s irrelevant to most of us.

But, this is the modern world, and friendly platforms exist for the rest of us to sign up to, choose investments according to a risk profile, and keep an eye on them.

Digital Management of your Wealth (in traditional finance)

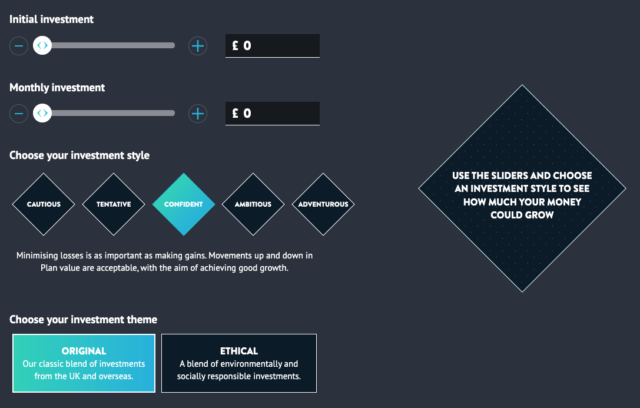

In traditional finance, a good example of a wealth management platform for consumers that acts as the front-end for traditional finance options is Wealthify, run by insurance giant Aviva. The first thing the website does is guide you to the right category of investment. For example, if we choose “General Investment”, then it gets to the nitty-gritty.

“Investment style” is a crucial choice, because that will influence the choice of funds that the platform chooses by default. “Cautious” could end up mostly in bonds and cash.

“Adventurous” could end up in developing market index tracker funds. Any in-person wealth manager would tailor your investment to your risk appetite in the same way.

So, as you can see, it’s a simple user interface. Note that environment-ravaging funds are called “classic” and “original”!

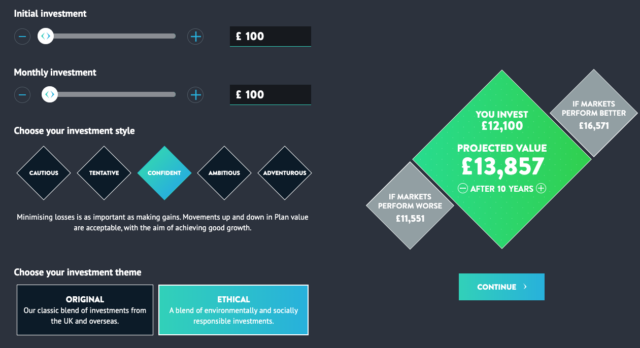

Let’s say we invest £100 initially and £100 a month on “confident” mode.

The interface says that after 10 years, we could get anything from “argh, where’s my money gone?” (£11,551) to “hmm, OK, maybe a holiday” (£16,571).

The lower figure is a yield of -2% (noooo). The middle one is a yield gain of 14.2% and the highest figure is a yield of 37%. Wow! Sounds great, right? Well, this is over 10 years.

An APY of 7% like you get against a crypto stablecoin such as USDC would give you a 7% return in one year, not 10!

Cautious mode’s return after 10 years is… weak. And you can still lose your original funds.

Have a look at TrustPilot to see what ordinary investors make of them. It’s a mixed bag.

Disappointing 10-year yields and fees eating into an investment are the reason that more and more people are turning away from traditional assets to virtual ones, and managing their digital wealth online (i.e. digital assets, such as crypto, NFTs and security tokens).

Management of your Digital Wealth (in DeFi)

Theoretically, any platform that has a lot of different investment options and allows you to track them is a wealth management platform – even a centralised exchange. And there are numerous DeFi platforms offering yields.

In the traditional finance world, there’s a whole arsenal of tools around the back that companies use to judge the risk of investment assets, from ratings reports to artificial intelligence. These don’t always exist in crypto. Sometimes it’s difficult enough to even work out what a coin is doing, let alone how risky it is. In traditional finance terms, all crypto is “confident” (stablecoins) to “ambitious” (Bitcoin, Ethereum), to “adventurous” (pretty much everything else).

So, in the crypto world, you need to manage your own risk profile. If that’s scary (spoiler: it usually is!), then you probably need to stick to “confident” mode (which would have a blend of safer stablecoins, and major crypto, for instance). Like traditional finance “past performance is no guarantee of future performance”, and “your capital might go up as well as down”.

Some platforms that lay claim to being “digital wealth management” platforms for crypto can actually be overwhelming, opaque and uncomfortably technical. The products on offer can be filled with hidden traps and danger, too.

The whole sector is a market that hasn’t matured yet, so while traditional finance and regulators seem to be OK with investment funds buying crypto, the companies themselves (with their friendly user interfaces and reassuring colours) haven’t moved into the crypto space yet.

But there are options!

It’s your decision of course, but a product that combines the features and simplicity of interest-bearing investment accounts with the potential returns of the crypto space might be deemed acceptable.

Such a product is offered by AQRU: you get a decent interest rate, your capital doesn’t go down (though the dollar value of crypto coins will always change, this doesn’t alter your balance), there is a selection of the safer cryptocurrencies (such as Bitcoin, Ethereum and USDC), great security, no fees except a $20 fee for withdrawing in crypto, and no lock-ins for most investment accounts.

You also get paid the same yield on all of your balance, interest is paid each day, and you don’t end up faffing around having to buy extra useless tokens to get the best rate.

If you’re interested in checking this out and getting a 10USDC bonus to invest and watch the figures fly, then onboard at AQRU.io or download the app from the App Store or Google Play. It’s more wealth-will-fly than Wealthify!