How can I start investing in DeFi?

Do you ever get the feeling that you exist to serve bankers, and not the other way round? Watching the world for the last few decades, it’s difficult to avoid the conclusion that the financial interests of most of us are not a priority for the high-powered, politician-heavy, over-entitled traditional financial industry.

DeFi (“Decentralised Finance”) grew out of Bitcoin and Blockchain, which themselves were an expression of dissatisfaction with an out-of-control traditional finance sector that almost destroyed itself in 2008 with its own greed – and which then made sure taxpayers were wiped out instead.

In its purest form, the vision for DeFi was an alternative banking system for the common man: incorruptible, transparent, and controlled not by greedy bankers or voracious middlemen, but by predictable, transparent sets of rules.

Of course, pure visions never last too long when a system gets actual people in it. However, even in its current imperfect form, DeFi is still a viable (and possibly the only) alternative for wealth building to the tilted playing field of the rich that makes up the stagnating world of traditional finance.

And after all, you’re here to learn how to build your wealth, right? Right.

Prerequisites

DeFi has a lot of promise, but it can’t create miracles: if you haven’t got at least some wealth to invest, then you’re not going to get very far.

For instance, the free 10USDC investment you get when you sign up for an AQRU Crypto savings account is excellent, but you’ll need more than that to provide wealth for the future!

DeFi and Traditional Finance

Fun fact: did you know that at 7% interest, with interest paid daily and compounded, it will take five years, nine months and nine days for your investment to double? And at 0.2%, a standard rate found in traditional finance, that would take you 235 years?

It’s a much more level playing field in DeFi than in traditional finance, where everything is tilted against the individual investor and in favour of the institutional investor. Their systems can see your share purchases and get in faster to screw you over. The gap between borrower/credit card interest rates and savings interest rates is just ludicrously large. The banks can turf you out of your house and deny you enough money to live. And, it turns out, they can also exclude you from the financial system entirely on a political whim.

Not so with DeFi. Regulatory issues and uncertainty about Crypto have so far prevented the banks from taking a major role in DeFi, so the gaps have been filled by individuals and small companies.

There’s a downside, of course – not all individuals and small companies have your best interests at heart either. Even if the technology is incorruptible, there’s no shortage of scams at the human end of Crypto – whether it be fake coins launched to make a mint, pump and dump scams that exploit human desperation, or hackers determined to steal it all by exploiting poorly designed code.

What this means is that to start investing in DeFi, it would be advisable to take a safety-first approach: in fact, that applies to all investing. Don’t invest more than you could afford to lose, and especially not the money you’ll need in the short-to-medium term.

What’s the Future of DeFi?

It depends on which part of DeFi you’re talking about: it’s a wide area, and there are some aspects that make politicians and regulators nervous: DEX in particular.

Technologically, Blockchain is the future and will invade traditional finance which has an infrastructure far more clumsy than it would appear from using it. Political meddling in the financial system might well drive entire countries to participate far more in DeFi.

Cryptocurrencies and Stablecoins will be joined by more CBDCs (“Central Bank Digital Currency”): China’s launch of its digital Yuan was a game-changer, and the US and UK are also discussing their own.

In general, regulatory pressure has increased on companies in the ecosystem and much closer attention is being paid to the parts of the ecosystem that have the most value: centralised exchanges and off-ramps to fiat currency. Exchanges and tokens that don’t pass regulatory approval will either close entirely or become close to worthless.

Major Cryptocurrencies, being safe from securities law, should continue unaffected, and approved tokens and Crypto might well increase in value substantially.

Digital Security tokens will take off as stocks and shares move to the Blockchain, with INX Securities leading the way as an SEC-regulated digital securities exchange. The normal stock exchange works only a few hours in the day and is unable to sell fractions of a share: it also takes days to settle a trade. With the Blockchain, it’s 24/7 transparent trading, fractional share purchase, and instant settlement. You’ve got to wonder how long it will take for stock exchanges worldwide to make that journey!

Making your Future Safer

The sure way to avoid regulatory problems later is to invest your funds with a trustworthy, secure and stable company that deals in more established Cryptocurrencies. Bitcoin and its derivatives like Bitcoin Cash, Ethereum, and a range of other properly decentralised Crypto, and Stablecoins that are properly backed.

One such company is AQRU, probably the simplest way to get started investing in DeFi, and offers at least assurance of customer service and adherence to the rule of law, though as with all investment decisions, your due diligence is required!

Getting started with AQRU.io

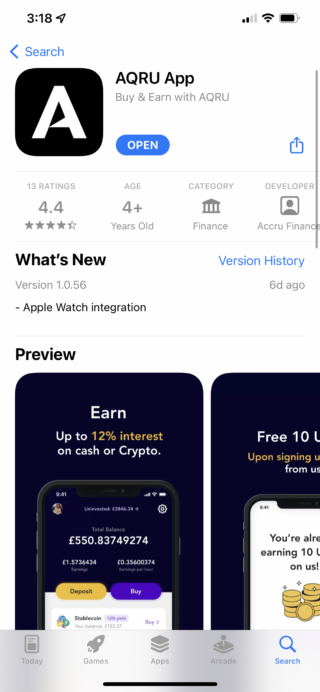

1. Download the app or visit the website

The AQRU app can be found on the App Store or on Google Play. You can also register via the website at AQRU.io – a website is really important for keeping track of your assets when using a mobile isn’t possible, or when you just want a larger screen and more features, and you can use your account on any of them.

Here, we’ll look at the iOS app.

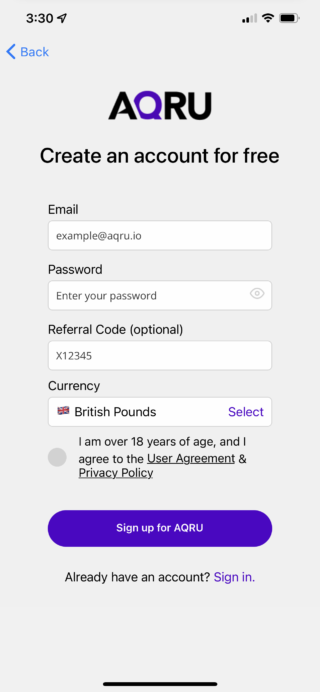

2. Open an account for free

Make sure you read the user agreement: it’s important.

Notice that there’s a referral code: you can get $75 for referring a friend, subject to them joining and depositing a certain amount of Crypto in their account. If a friend referred you, then do them a favour and use the code! You’ve nothing to lose!

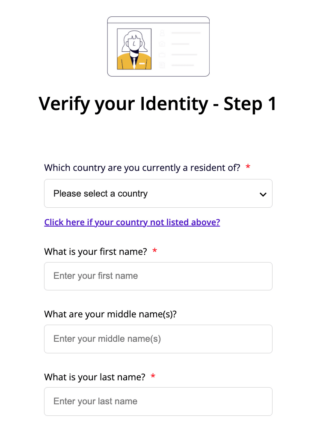

3. Verify your identity

Are you really you? Now’s your chance to prove it to AQRU!

This step involves uploading a photo ID, proof of address, and also taking a selfie. Make sure you do that Crypto scowl that says “I’m enduring this long enough to make 7% yield but I’m not happy about it, plus my eyebrows look strange”.

The verification process is manual, so patience may be required.

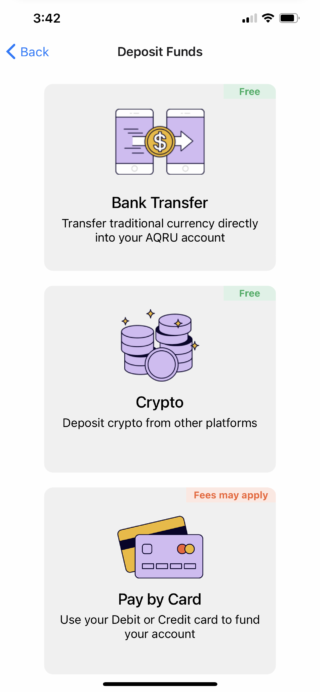

4. Deposit funds

You already have 10USDC, but of course, you’ll probably need more. The minimum deposit is 100 Euros, and there’s no deposit fee, other than fees that may apply by buying Crypto through MoonPay. Click or tap “Deposit” once you’ve verified, and exercise your right to choose from these options:

Bank transfers supported are EUR and GBP (EUR deposits use SEPA, whilst GBP deposits are completed through FPS and may take up to 48 hours to appear in your account).

Crypto transfers are sent to a wallet address provided by AQRU (represented by a QR code you can scan into the wallet or exchange you’re sending the Crypto from). The Crypto appears in your account when the transaction has been verified by the Blockchain.

Note that while AQRU doesn’t apply fees to receiving it, you will have to pay Blockchain transmission fees for sending it (and exchanges may charge a withdrawal fee).

5. Earn!

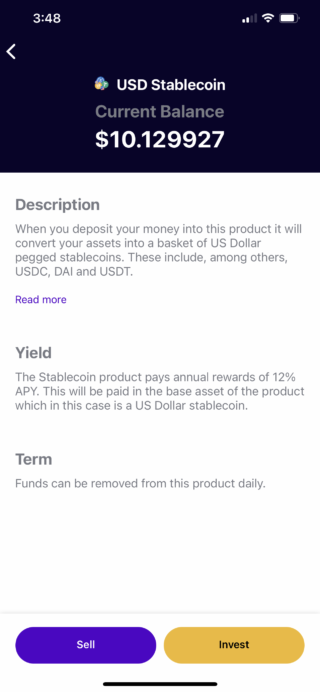

You’re not quite invested yet! To do that, you need click on the “Buy” button to move funds into your investment account. Here’s what you see when you do this with USD – note that it’s a basket of Stablecoins rather than just one, which improves stability even further. A super Stablecoin, if you like!

6. Watch your earnings grow

Interest is displayed per second as you watch but properly added to your account daily for interest calculation purposes. Bank savings accounts vary, but most only add your interest per month, so that’s another advantage of AQRU.

So what are you waiting for? Join AQRU today!