What is a stablecoin?

Stablecoins have been in the crypto news recently, implying that despite their name, they’re… less than stable.

However, as usual, there’s a lot of fuss made by people who don’t know one end of a stablecoin from the other to make a wider point, which is “crypto bad, mmhkay?”.

What is a stablecoin

One definition from USD coin’s website is this:

“A stablecoin is a blockchain-powered digital currency that combines the benefits of open, borderless cryptocurrency with the price stability of traditional fiat currencies.”

… which is true but misses out on some important information. Stablecoins are stable, yes – but stable against what?

The answer is: they’re stable against real-world digital assets. USD coin (USDC) is stable against the US dollar. There are other US dollar stablecoins too, such as PAX (USDP), Tether (USDT), DAI, and “True US Dollar” (TUSD). There are gold stablecoins like PAXG, euro stablecoins (there aren’t as many of these, but EURS is a big one), and even Japanese Yen stablecoins (GYEN).

Why are stablecoins important?

Blockchain’s connection to the financial systems is… well, not really there. Fiat currencies and digital currencies require a lot of effort to talk to each other. That would make trading between one and the other a horrible experience… if it wasn’t for stablecoins. Stablecoins allow financial activity in “real” money with all the convenience of the digital asset ecosystem. Without that, no one would know what anything was worth in the “real” world.

What can you do with stablecoins?

Now that there are debit cards running off some fiat stablecoins, you can do pretty much anything you can do with “real” dollars. With a dollar stablecoin you can send it back and forth, and convert it to other currencies (digital, and other stablecoins). You can lend them, or borrow them, or you can actually pay for things (gasp!).

Not all stablecoins are created equal, though. Different stablecoins are for different things: you won’t be able to buy some groceries with a debit card backed by gold stablecoins, for instance.

Types of stablecoin

They say the devil’s in the detail, and that’s especially true with stablecoins. Did you know there are hundreds of them? But there are very few that you’d actually trust for any length of time (though they might be useful for temporary trades). We’re only going to cover currency stablecoins in this next section.

Fiat-collateralised stablecoins

How could a digital dollar be worth an actual dollar? Well, if that invisible coin can be redeemed for a real dollar, and if its exchange value is always one dollar (regardless of how many of it are bought and sold), you could argue that it’s worth a dollar.

In this category of stablecoins, the worth of the coin is directly linked to the assets of the company producing the coin that they have put aside for redemptions.

USDC (US dollar coin) from Circle is the biggest and is fully backed by US dollars. (it’s also the most regulated and audited stablecoin). At the time of writing, there are around 53 billion in circulation.

USDC publish a monthly audit: you can find April 2022‘s here.

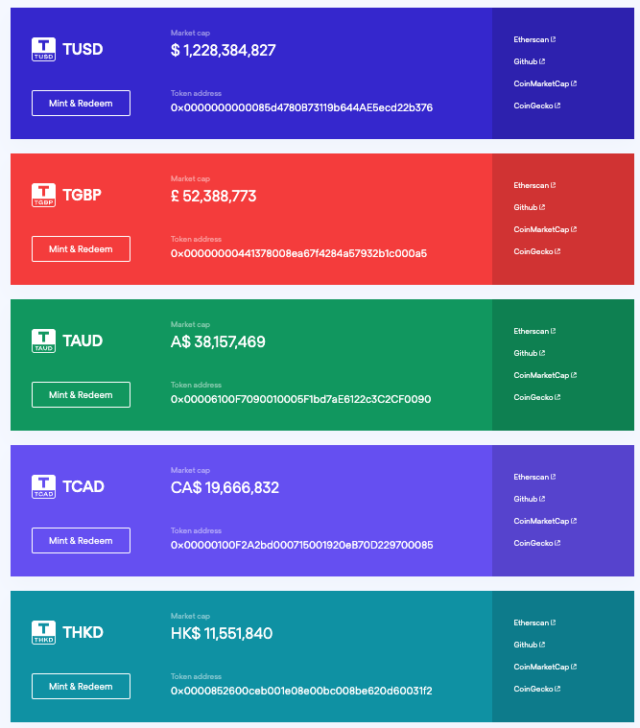

The company “Trust Token” offers stablecoins in multiple currencies, fully backed by reserves. Some of these coins are listed at exchanges, so foreign exchange is also possible.

The company Paxos also offers a fully collateralised US Dollar Stablecoin.

But in terms of take-up in DeFi, USDC seems to be the industry leader.

One USD stablecoin that’s suffered from doubt about its real reserves is USDT: Tether. While it has been stubbornly resistant to various attacks over the years, doubts persist, and more reputable coins are in the ascendancy.

Crypto-collateralised stablecoins

File this under: “er, massively complicated”. If you have a crypto coin that is backed by other cryptocurrencies, then you’ve created a potentially large problem for yourself. In general, this problem is addressed by “over-collateralisation”. That is, you store more crypto than the value of the coins you’ve issued. This becomes a problem again if the value of your collateral dips quickly so that the coin is under-collateralised.

The coin DAI, which is actually the first stablecoin, is a crypto-backed stablecoin that’s historically done quite well with maintaining its peg. It’s not just backed by crypto, but by complicated and headache-inducing lending and borrowing activity. It’s living on the edge of danger, though.

Algorithmic stablecoin

The difference between a crypto-collateralised stablecoin and an “algorithmic” stablecoin is that the crypto-collateralised one uses established crypto with a known and independent value, such as bitcoin or ethereum.

An algorithmic stablecoin is one that creates additional coins to trade against the main stablecoin and then uses logic to keep the value stable. Sometimes (like the notorious and recently-crashed UST coin) an ecosystem has some crypto collateral anyway for emergencies. This can create its own problems if something goes wrong, and the algorithms dump it on the market.

So, like perpetual motion, while algorithmic stablecoins can work for a while, they’ve never succeeded indefinitely. There’s a long list of coins that have failed (i.e. lost their peg to the dollar): for instance, in the mid-May crash, coins fUSD and DEI lost their peg in the general melée.

Verdict: you know that bargepole you own? Don’t use it in proximity to these coins!

Earn interest on stablecoins

I think we’ve established that you should only invest in regulated, asset-backed stablecoins.

One of the quirks of the crypto ecosystem is that you can earn more interest on fiat stablecoins than you can on fiat. This is because there’s a lot less of it, so there’s more borrowing demand, and you can do interesting new things with it in the digital ecosystem. Most of those things are a bit like gambling, but they’re still things, and people still borrow stablecoins to do it.

You can earn a competitive rate of interest on USDC stablecoins at AQRU through our crypto yield-bearing account, as well as being able to diversify into bitcoin and ethereum, and AQRU’s Maple USDC account, which offers even better rates.

You can onboard at the AQRU website. Once you’ve registered and been verified, you can fund your account with the USDC you already own or send in those pesky real pounds or euros you’ve been dying to get rid of, with no deposit fees (there is a minimum deposit of the equivalent of 100 euros).

You can even buy new USDCs with a debit card through the in-app provider MoonPay, though fees apply for that.

After that, press the “invest” button, and watch the digits fly.